A ratio of 21 or higher is considered satisfactory for most of the companies but analyst should be very careful while interpreting it. Note Working Capital Current Assets-Current Liabilities.

Liquidity Ratios Accounting Play

Current Ratio Tutor2u

Current Ratio Meaning Interpretation Formula Calculate

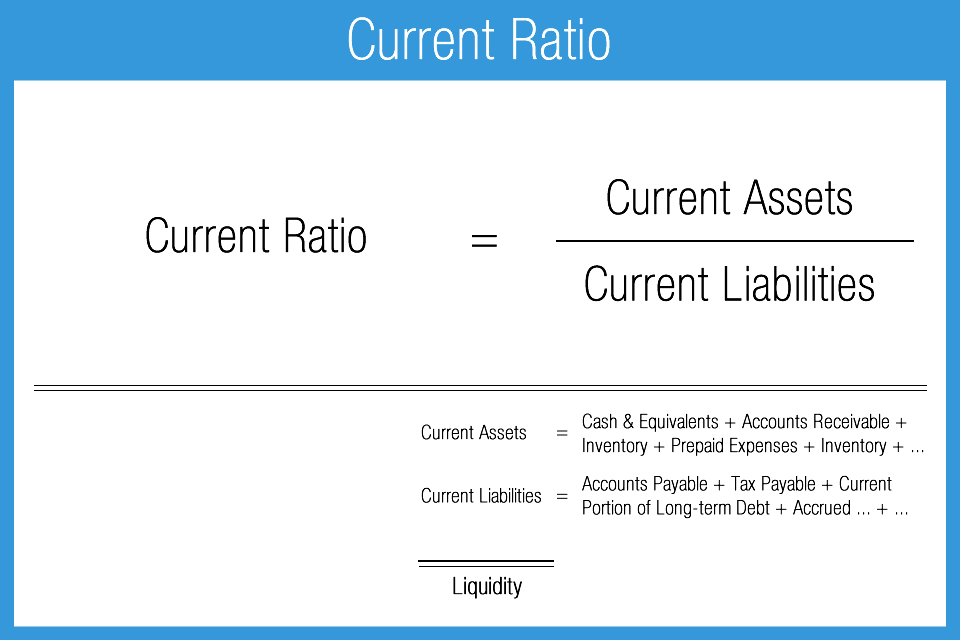

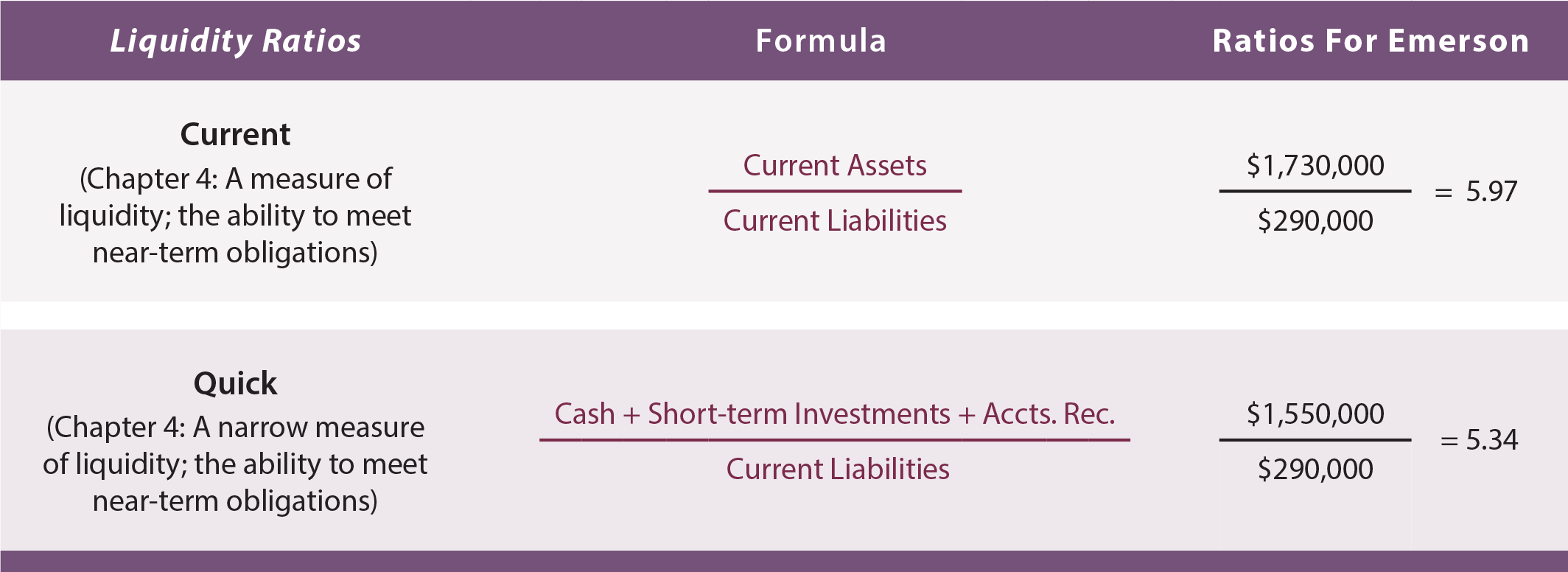

The formula used for computing current ratio is.

Current ratio interpretation example. If Current Assets Current Liabilities then Ratio is less than 10 - a problem situation at hand as the. For every 1 of current liability the company has 119 of quick assets to pay for it. A ratio above 1 means that a company will be able to pay.

Current Assets Current Liabilities. In many cases a creditor would consider a high current. The acid-test ratio can be calculated as follows.

Practice calculating the current ratio for 2011. This ratio shows us whether the companys current assets are sufficient to pay its short-term liabilities. The current ratio which is also called the working capital ratio compares the assets a company can convert into cash within a year with the liabilities it must pay off within a year.

Current Ratio 642543 118X. The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term obligations that are due within a year. If the current ratio computation results in an amount greater than 1 it means that the company has adequate current assets to settle its current liabilities.

The relationship between the price for which a unit of livestock can be sold in the commodities markets and the price of the food required. A higher current ratio indicates the higher capability of a company to pay back its debts. This implies that a significant amount of PG current asset is stuck in lesser liquid assets like Inventory or prepaid expenses.

A quick analysis of the. It indicates the financial health of a company. 1 means the business is able to pay all of its current liabilities from the cash flow of its own operations.

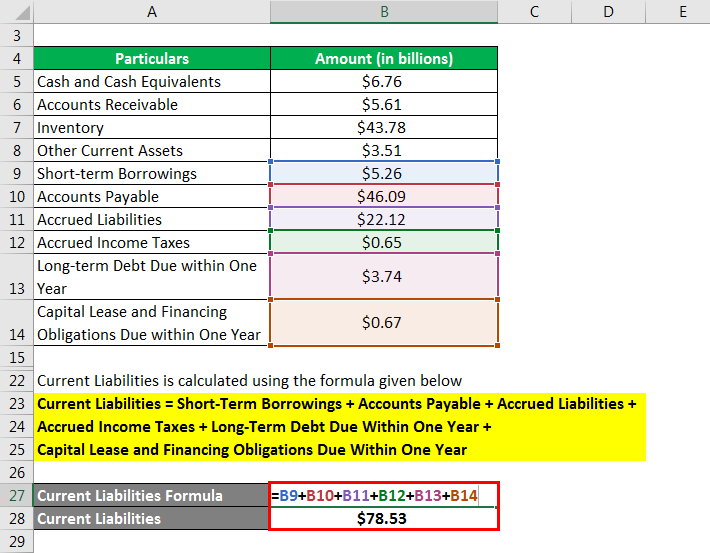

In this example we will consider the Financial Statement of Walmart. The reserves-to-production ratio RPR or RP is the remaining amount of a non-renewable resource expressed in timeWhile applicable to all natural resources the RPR is most commonly applied to fossil fuels particularly petroleum and natural gasThe reserve portion of the ratio is the amount of a resource known to exist in an area and to be economically recoverable proven reserves. In the example above the quick ratio of 119 shows that GHI Company has enough current assets to cover its current liabilities.

Absolute liquidity is represented by cash and near cash items. Debt to Capital ratio Using Excel. Current Ratio Current Assets Current Liabilities So if the current assets amount to 400000 and current liabilities are 200000 the current ratio is 21.

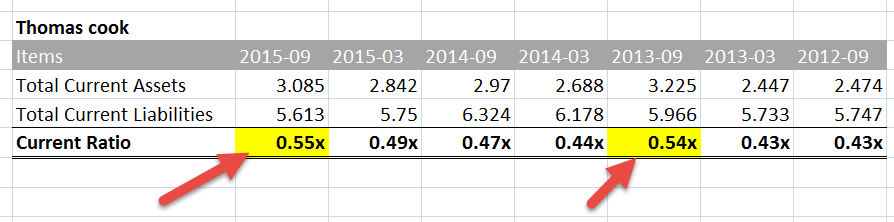

Your answer for 2011 should be 154X. Significance and interpretation. The ratio considers the weight of total current assets versus total current liabilities.

The ideal ratio depends greatly upon the industry that the company is in. A higher working capital indicates that a company is utilizing its working capital very efficiently. P.

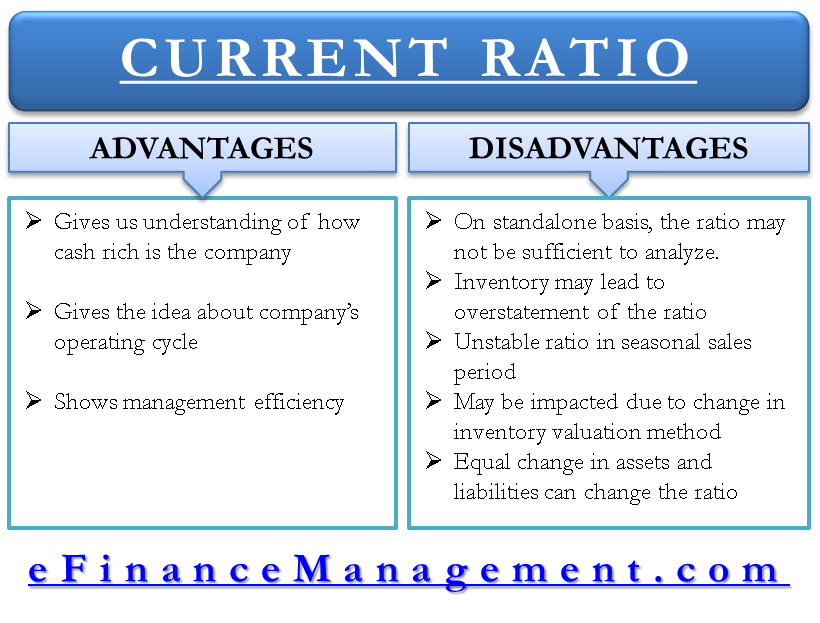

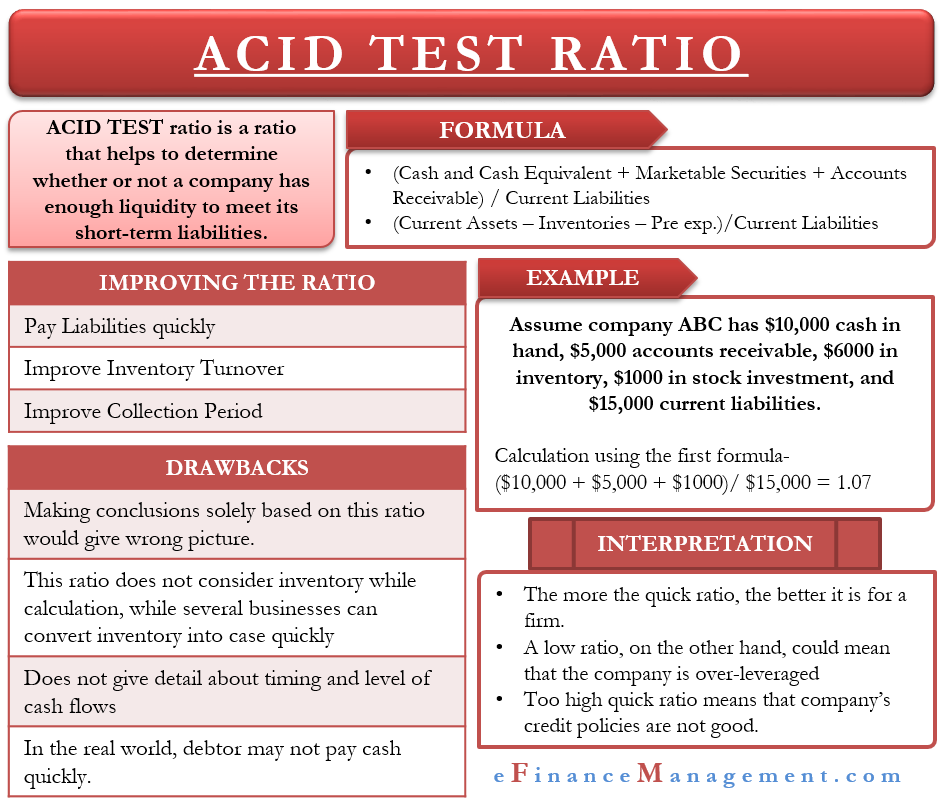

Inventory is the most notable exclusion since it isnt as rapidly convertible to cash and is often sold on credit. Though this ratio is definitely an improvement over current ratio the interpretation of this ratio also suffers from the same limitations as of current ratio. The current ratio is a very good indicator of the liquidity position of the company amid certain limitations which one needs to keep in mind before using and interpreting the ratio.

The cash ratio indicates to creditors analysts and investors the percentage of a companys current liabilities that cash Cash In finance and accounting cash refers to money currency that is readily available for use. Current ratio is a comparison of current assets to current liabilities. For 2010 take the Total Current Assets and divide them by the Total Current Liabilities.

In the above example XYZ Company has current assets 232 times larger than current liabilities. For example if a company has 100000 of current assets and 50000 of current liabilities then it has a current ratio of 21. Calculate your current ratio with Bankrates calculator.

Current ratio is a useful test of the short-term-debt paying ability of any business. It compares a firms current assets to its current liabilities and is expressed as follows- The current ratio is an indication of a firms liquidityAcceptable current ratios vary from industry to industry. If Current Assets Current Liabilities then Ratio is greater than 10 - a desirable situation to be in.

It is one of a few liquidity ratios including the quick ratio or acid test and the cash ratio that measure a companys capacity to use cash to meet its short-term needs. A low working capital ratio is an indicator that the company is not operating at its optimum. Interpretation of Current Ratios.

This ratio serves as a supplement to the current ratio in analyzing liquidity. It may be kept in physical form digital form and cash equivalents will cover. A current ratio value equal to 1 is usually a limit which means current assets are equal to current liabilities.

Accounts receivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. We will look at a detailed interpretation of the ratio in a later stage. As part of the practical application let us look at how to calculate the ratio using Excel.

The Current Ratio formula is Current Assets Current Liabilities. Acid-Test Ratio Formula. However its quick ratio is 0576x.

If Current Assets Current Liabilities then Ratio is equal to 10 - Current Assets are just enough to pay down the short term obligations. If it is less than one it can mean the company has a liquidity problem. In other words the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year.

It is a ratio of absolute liquid assets to current liabilities. The current ratio is a liquidity ratio that measures whether a firm has enough resources to meet its short-term obligations. One can look to use an acid test ratio that does away with some limitations of the current ratio.

Interpreting the Current Ratio. The current ratio on the other hand. Current assets are liquid assets that can be converted to cash within one year such as cash cash equivalent accounts receivable short-term deposits and marketable securities.

However any of these ratios should be used in comparisonconjunction with other measures to interpret the short. 1 is considered very comfortable because having a ratio of 1. A higher current cash debt coverage ratio indicates a better liquidity position.

The quick ratio also referred as the acid test ratio or the quick assets ratio this ratio is a gauge of the short term liquidity of a firm. Another common acid test ratio formula is. Significance and interpretation.

This means that the company can pay for its current liabilities 118 times over. The acid-test ratio eliminates all but the most liquid current assets from consideration. Generally a ratio of 1.

One example of a far-reaching liquidity crisis from recent history is the global credit crunch of 2007-08. Current ratio Current assets Current liabilities. How Current Ratio Analysis is Used There are several ways to review the outcome of the current ratio calculation.

A higher working capital turnover ratio is always better. Interpretation of the Cash Ratio.

Current Ratio Examples Of Current Ratio With Excel Template

Advantages And Disadvantages Of Current Ratio

Financial Statement Analysis Principlesofaccounting Com

Liquidity Ratios Current Ratio And Quick Ratio Acid Test Ratio Youtube

Quick Ratio Or Acid Test Ratio Double Entry Bookkeeping

Q A How Is The Current Ratio Calculated And Interpreted Tutor2u

Current Ratio Ratiosys

Acid Test Ratio Meaning Formula Drawbacks And More